Saving for Retirement in Guatemala

U.S. Tax considerations.

The Tax Corner by John Ohe.

Living abroad, many U.S. expats give too little thought to saving for retirement. Some basic financial planning is absolutely critical, and helps to avoid the unenviable position of reaching retirement age without sufficient funds.

The purpose of this article is to provide food for thought and encouragement to consider the following questions:

• How does Social Security factor into my retirement plans?

• How am I saving today to fund my retirement years?

• Will I have saved enough to retire comfortably?

• Am I investing wisely?

Let’s start with Social Security. There is a lot of concern regarding the future stability of the U.S. Social Security system. Nevertheless, for most people, it will be an important source of income during retirement. We often have discussions with clients regarding this topic. Usually, the discussions are with U.S. expats (or dual citizens) who have not attained the necessary 40 credits. If you fall into this category, don’t give up on Social Security. There are paths to qualifying (although it will likely require advanced planning). Important to note: Social Security is a safety net. It highly favors those that earn less, relative to those in the high income brackets.

After Social Security, funding a retirement account is the next logical step. An Individual Retirement Account (IRA) is a fantastic retirement saving vehicle. However, for many U.S. expats, contributing to an Individual Retirement Account (IRA) can be “technically” challenging. That is because they exercise the foreign earned income exclusion on their tax return, and have no taxable income (a requirement to contribute to an IRA). Similar to Social Security, there are paths to being able to contribute to an IRA. Too many tax accountants blindly exercise the foreign earned income exclusion without adequate thought to the client’s unique situation.

In terms of how much to save for retirement, Fidelity Investments recently came out with some guidance. Fidelity suggests savers have 1 times their salary or income at age 35, then 2 times at 40, 3 times at 45, and so on in increments up to age 60 (at which point, 6 times one’s income). These figures do not factor income from Social Security.

In terms of how much to save for retirement, Fidelity Investments recently came out with some guidance. Fidelity suggests savers have 1 times their salary or income at age 35, then 2 times at 40, 3 times at 45, and so on in increments up to age 60 (at which point, 6 times one’s income). These figures do not factor income from Social Security.

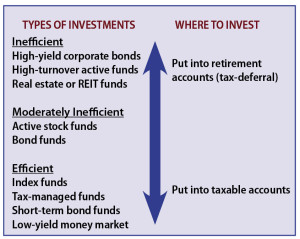

Investing wisely is not a “one size fits all” approach. First, retirement funds should be treated separately from non-retirement funds. Second, think about risk before return. Too often, people get enamored by how much money they think they can make before realizing the risk profile of an investment. Remember, as you get older, the risk profile of your investment portfolio should get more conservative. Third, achieve tax efficiency with your investments. The general rule of thumb is to put “less tax-efficient” investments into retirement accounts and “more tax-efficient” investments into taxable accounts. —-

This article was written by John Ohe (IRS enrolled agent and chartered financial analyst). John is a partner at Hola Expat, which specializes in preparing tax returns for U.S. expats. If you would like to submit a tax-related question, email: info@holaexpat.com

Disclaimer: The answers provided in this article are for general information, and should not be construed as personal tax advice.

Tax laws and regulations change frequently, and their application can vary widely based on specific facts and circumstances.