Key Tax Changes for 2016

With the New Year underway, we’d like to take this opportunity to review the

important tax changes impacting U.S. expats living around the world.

by John Ohe (IRS Enrolled Agent).

3 Extra Days to File Tax Return

Normally, U.S. tax returns are due April 15—before penalties and interest begin to accrue. However, the deadline this year is April 18 because Emancipation Day happens to fall on a Saturday. Without change, U.S. expats have until June 15 to file their tax returns. Please note that interest charges begin accruing on April 18 (when taxes are owed).

IRS Can Revoke Passports

A new law signed on Dec. 4 provides the IRS with the ability to revoke a passport when one has a tax debt exceeding $50,000. U.S. expats often do not know that they have an outstanding tax debt (e.g., cashed out of retirement accounts prior to leaving the States). Furthermore, penalties and interest charges accrue rapidly and can quickly exceed the original tax bill.

Increase in the Foreign Earned Income Exclusion

The foreign earned income exclusion, widely used by U.S. expats to minimize taxable income, has been increased to $100,800 for 2015. Standard deduction and exemption amounts work in conjunction apply on top of the foreign earned income exclusion. Bottom line: One can have income exceeding $100,000 and not owe taxes to the IRS.

Obamacare Penalties Increase

The Affordable Care Act (aka Obamacare) was created to bring affordable health coverage to all U.S. persons. The law requires everyone to obtain adequate health insurance coverage or pay a penalty via the tax return. Obamacare penalties are increasing this year to the greater of $695 per adult and $347 per child, or 2.5% of household income.

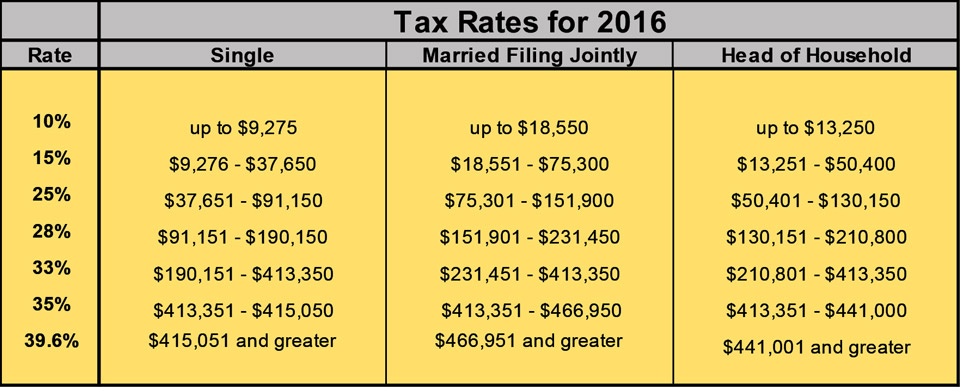

Tax Rate Table for 2016

The table below details the marginal tax rates applicable for this year. The rates are based on taxable income (before deductions, exemptions and exclusions).

This article was written by John Ohe (IRS enrolled agent and chartered financial analyst). John is a partner at Hola Expat, which specializes in preparing tax returns for U.S. expats. If you would like to submit a tax-related question, email: info@holaexpat.com

Disclaimer: The answers provided in this article are for general information, and should not be construed as personal tax advice.

Tax laws and regulations change frequently, and their application can vary widely based on specific facts and circumstances.